Author: Student at LUC

Franklin D. Roosevelt once said, “The test of our progress is not whether we add more to the abundance of those who have too much; it is whether we provide enough for those who have too little” (FDR Library & Museum 2016).

He raises an important point: To ensure equality and fairness for all, it is not only important to maintain an overview of the economy as a whole, but to dedicate special attention to the status of the less privileged as well. But how do we determine what is enough?

The Dutch Poverty Line

One way to go about this is by determining a poverty line as both a starting point and a reference. In the Netherlands, this is done by the Social and Cultural Planning Office (SCP). The SCP distinguishes between two different reference budgets, namely the basisbehoeftenbudget (BBB, English: basic needs budget) and the niet-veel-maar-toereikendbudget (NVMT, English: not much but sufficient budget) (SCP 2019). Both vary based on the composition of the household and the age of the recipient.

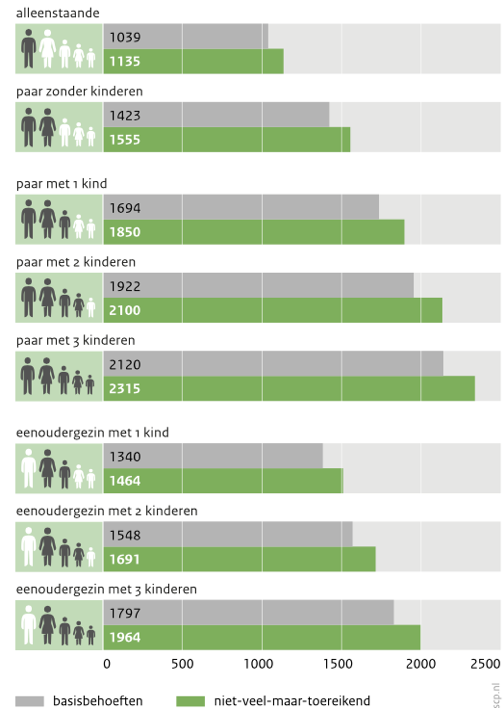

Figure 1. Reference Budgets for the Netherlands in 2017

Figure 1. Reference Budgets for the Netherlands in 2017The BBB is the stricter budget, said to cover “all necessary or highly desirable expenditures” (SCP 2019). The NVMT on the other hand also takes into account the minimum expenditures for “relaxation” and “social participation” (SCP 2019). In 2017, the BBB for a solitary household was 1,039€/month while the NVMT was 1,135€/month (see Figure 1 for an overview).

These reference budgets have significant consequences for those receiving governmental aid as those who rely on these specified amounts to actually cover their expenditures may not be able to meet their basic needs if miscalculations are made. It is thus important to determine whether these reference budgets reflect real costs and contexts. Naturally one may then question: how did the SCP arrive at this number and to what extent are their calculations applicable to the real world?

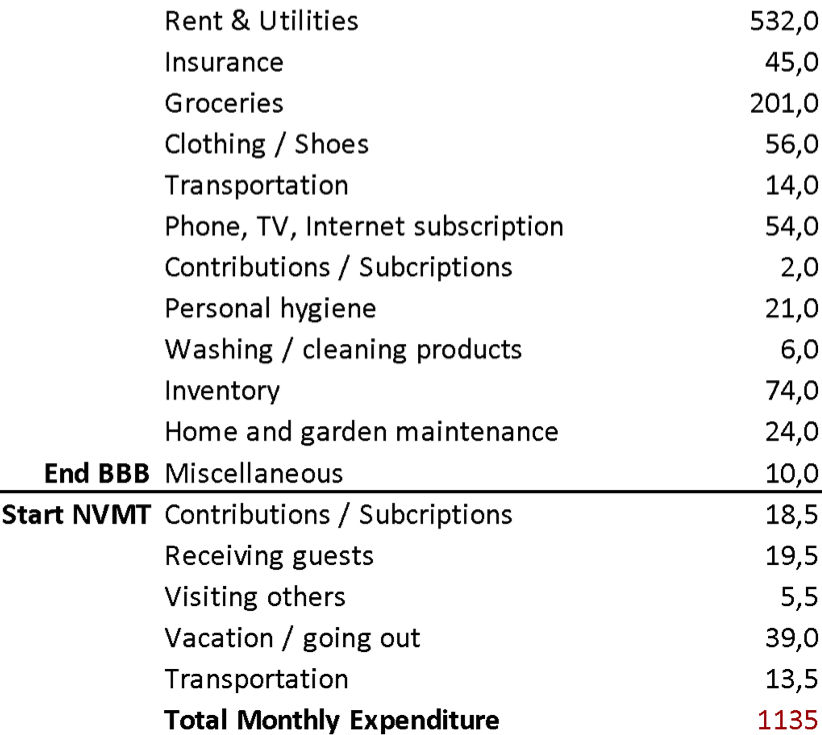

Figure 2. Reference Budgets Prepared by the SCP

Figure 2. Reference Budgets Prepared by the SCPFigure 2 shows the BBB and NVMT reference budgets for the entirety of the Netherlands as calculated by the SCP. Can residents of The Hague cover their basic and broader needs with these amounts?

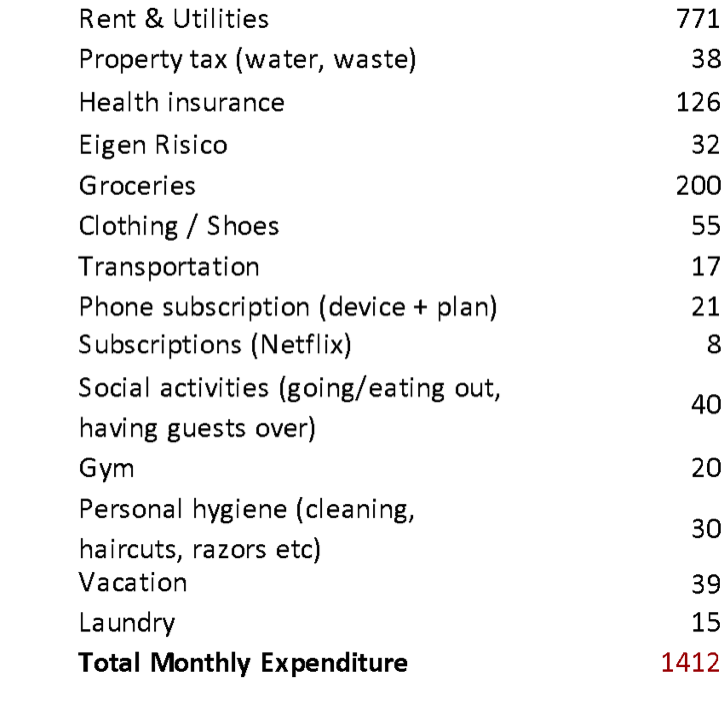

Figure 3. Estimate of Actual Expenses by the Author

Figure 3. Estimate of Actual Expenses by the AuthorThe amounts in Figure 2 may seem reasonable at first. When comparing them to actual living expenses however, a discrepancy quickly becomes evident.

First and foremost, rent prices are typically higher than the reference budget estimates. According to a report by Kamernet B.V. (2019) – a private rental agency – the average price of a studio in The Hague in 2019 was 728€ with an increase in rental prices of 13.22 percent since 2017.

Moreover, the insurance expenditures that are calculated amount to 45€ according to the SCP, however, a search for the cheapest health insurance amounts to 87€ (Goedkoopste Zorgverzekering 2020). Yet, opting for such an insurance scheme could be detrimental to one’s finances as dentistry coverage among other things are not included. The most reasonable insurance plan that would prevent one from suffering from unexpected health related expenses, e.g. from routine visits (such as dental check-ups) or small accidents, and therefore the most prudent financial decision would cost 126€.

Even if health benefits are subtracted from this amount however, there would still be insufficient space in the budget to allocate money to expenditures from one’s Eigen Risico. Yet, the SCP mentions that governmental benefits received are not included in their calculations of expenditures but instead added to the calculations of the income (SCP 2019). This means that expenditures should reflect their gross rather than net amounts.

Similarly, the prices of self-care are also underestimated: A regular haircut costs at least €20, which would amount to €120 on an annual basis if one was to get a haircut every 2 months. Another important item that is not considered by the NVMT are the property taxes that one has to pay for the use of drinking water systems and waste processing, both of which are calculated to cost a total of €38 per month.

The Consequences of the Poverty Line

The same can be said for several other items in the overview. Thus, while these estimates may be applicable to large parts of the Netherlands, the SCP nevertheless seems to miscalculate the living expenditures of residents living in The Hague. The poverty line is thus drawn too low.

This discrepancy has several consequences: Not only does it imply that possibly many more people in the Netherlands could classify as poor, it also implies that many of those living from the budget determined by the SCP are put under significant and unnecessary financial and psychological strain.

The shortcomings of the SPC estimates are further demonstrated by the wide divergence between the two calculated monthly budgets and the minimum monthly income, which was determined to be 1,680€ in 2020 (based on full-time employment and the adult minimum wage) (Rijksoverheid 2020). Even single households earning the minimum monthly income remain eligible for governmental rent and health insurance benefits, implying that they are earning below the norm and are by no means living royally (for comparison: the median household income in the Netherlands was approximately 25,000€ annually or 2,084€ on a monthly basis in 2018) (CBS 2019; Belastingdienst 2020). Even the less strict NVMT is thus 545€ below the minimum monthly income.

Surviving or Living?

The calculations made by the SCP seem to encourage imprudent financial decision-making. This is demonstrated for example by its push for insurance plans that could land those with already fragile finances into more distress when faced with unexpected occurrences.

Life should not revolve around simply staying alive. It should also be about having a life that you can make your own – especially in a resource-rich country such as the Netherlands. Thus, both the BBB and the NVMT should be re-evaluated and based on actual living standards.

References:

Belastingdienst (2020). “Proefberekening Toeslagen.” Belastingdienst. At https://www.belastingdienst.nl/rekenhulpen/toeslagen/.

FDR Library & Museum (2016). “Franklin D. Roosevelt.” Franklin D. Roosevelt Presidential Library and Museum. At https://www.fdrlibrary.org/fdr.

Goedkoopste Zorgverzekering (2020). “Goedkoopste Zorgverzekering 2021 Vinden en Afsluiten?” GoedkoopsteZorgverzekering.nl. At https://www.goedkoopstezorgverzekering.nl.

Kamernet B.V. (2019). „Kamernet (Ver)huurmarkt Rapport 2019.” Kamernet B.V. At https://resources.kamernet.nl/content/pdf/Verhuurmarkt_Rapportage_Kamernet_2019.pdf.

Kappers.nl (2018). “Hoeveel Kost een Knipbeurt bij de Kapper?” Kappers.nl. At https://www.kappers.nl/blog/hoeveel-kost-een-knipbeurt-bij-de-kapper.

Rijksoverheid (2020). “Bedragen Minimumloon 2020.” Rijksoverheid. At https://www.rijksoverheid.nl/onderwerpen/minimumloon/bedragen-minimumloon/bedragen-minimumloon-2020.

CBS (2019). “Inkomensverdeling.” CBS Statistics Netherlands. At https://www.cbs.nl/nl-nl/visualisaties/inkomensverdeling.

SCP (2019). “Waar Ligt de Armoedegrens.” Sociaal en Cultureel Planbureau. At https://digitaal.scp.nl/armoedeinkaart2019/waar-ligt-de-armoedegrens/.